What makes a mortgage company the best mortgage company?

The Best Rates, The Highest Payouts, Nationwide Coverage, and Multiple Opportunities

That's what makes for the BEST Mortgage Company

Powered by one of the nation's largest wholesale lenders

Getting you the most up-to-date rates...

The Right Rate Makes All the Difference

Our wholesale rates are among the most competitive in the industry.

With access to over 120 lenders , your clients get the lowest rates while you maximize your compensation.

Our pricing is designed by Loan Officers for Loan Officers, to deliver the perfect blend of pricing and payout. Whether working with Lender-Paid Compensation (LPC) or Borrower-Paid Compensation (BPC), our banks have a set payout between 0% to 2.75%. You can switch back and forth between banks, as needed to to minimize rate and maximize compensation.

Email me today for our full lender list and compensation breakdown.

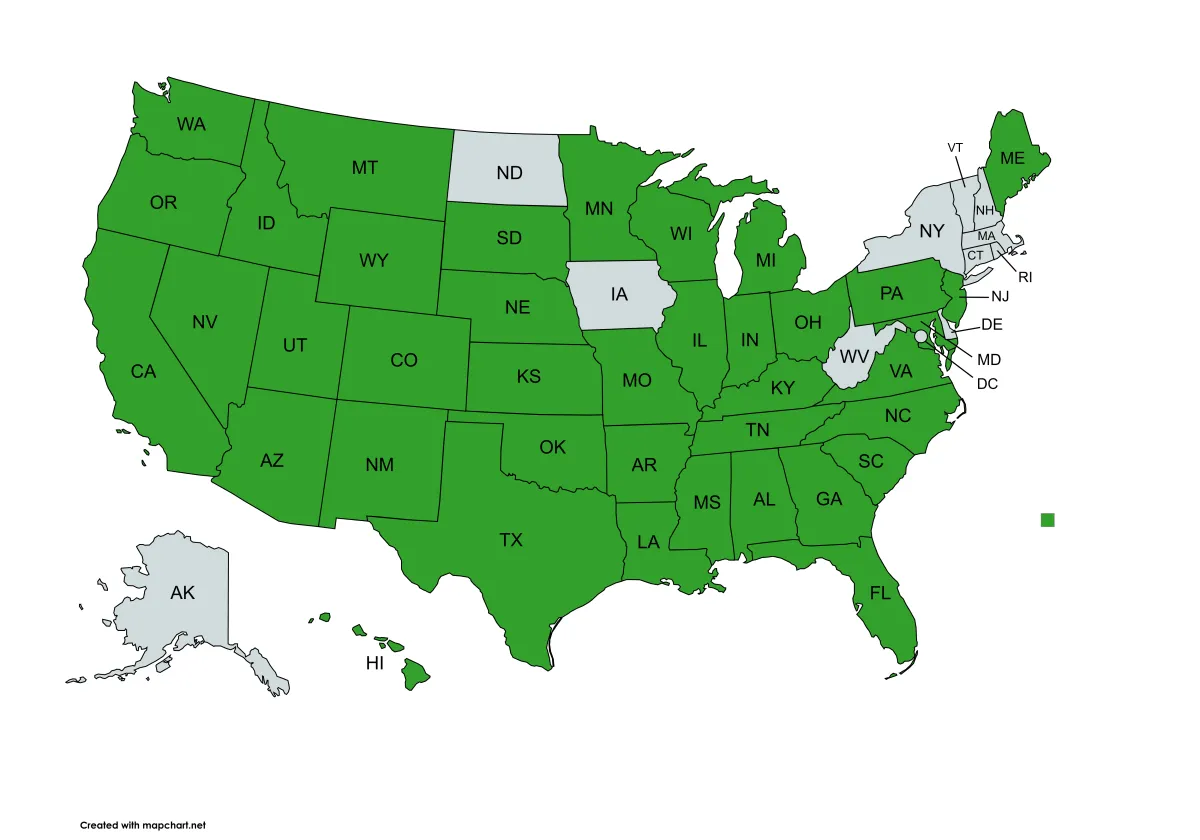

Coast to Coast coverage and ready to serve everyone in between

We are licensed and operating in over 39 states and allow you to tap into a wide range of loan types, including real estate, commercial, and hard money loans.

AL, AZ, AR, CA (DRE & DBO), CO, FL, GA, HI, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NJ, NM, NC, OH, OK, OR, PA, SC, SD, TN, TX, UT, WA, WI, WY

All The Benefits of Payouts designed by LOs

Payout structures that reward you best for your hardwork.

Maximize your earnings with a 1099 setup. A $10,000 commission at a 90% split means $9,000 in your pocket, compared to just $5,000 on a typical W2 payout.

Choose the payout structure that rewards you best for your hard work.

Flexible Compensation Plans

Tailor your compensation to each deal. With different compensation structures available from every lender, you have the flexibility to choose the ideal comp option—whether it’s a zero-comp for BPC or a high-comp payout up to 2.75%. You control your income without compromising the transaction.

You control your income without compromising the transaction.

Lightning Fast Payouts - Why wait for your money?

Get paid quickly with no minimum production requirements and payouts processed within 2-4 days.

You've earned it now receive it

Content Creation and Lead Generation Ready

Enjoy complimentary marketing services to help grow your business. We provide the tools and resources to help you thrive.

The Benefits of Loan Pricings designed by LOs

Diverse Loan Offerings

Real estate, commercial, and hard money loans. Expand your portfolio and tap into more revenue streams while working on deals that best suit your clients' needs.

Advances on Current Production

Need access to cash flow? We offer advances on your production, ensuring you have the liquidity to keep your business moving forward without interruption.

Reverse Mortgage Department

We offer one of the most extensive reverse mortgage departments in the industry. Our average payout is $22,000 per transaction, and you'll have access to top-tier mentor programs to elevate your expertise and close even more deals

Increase the number of and ways you can help people

AND

Control how & when you get paid